One of the world’s pre-eminent financiers explains why a more pragmatic approach is needed in designing climate solutions.

I believe that there are five big, interrelated forces that are driving, and always did drive, big changes in the world order, and they are:

1 the debt/money/economic force that is manifested in market and economic movements,

2 the internal conflict force that is most obviously manifested in political conflict,

3 the external conflict force that is most obviously manifested in geopolitical wars,

4 acts of nature that are most obviously manifested in climate change, and

5 humanity’s inventiveness, especially of technology development that is most obviously manifested in AI development.

My synthesis of the climate change picture

Since I recently spent 12 days at the COP28 meeting and thought a lot about the climate change issue, though my main area of focus is the ocean (www.oceanx.org), now is a good time to share my thoughts about how this force will have a big effect on the changing world order. My thoughts are based on my studying a lot of research of others rather than my own original research. While the pictures painted in the research I studied have imprecisions in the numbers behind them and big variations in expectations because of uncertainties, the basic big picture seems clear, though I don’t think that it has been well-synthesized. So, what I’m going to do is try to synthesize the picture and give my own outlook that is based on that synthesis. Here it is:

1. Climate change is happening in a big way and will, one way or another, inflict very large costs on the world (up to 5% of world GDP). Those estimated costs will be spent on a mix of 1) trying to minimize climate change (e.g., minimizing temperature increases above 1.5°C by doing things like creating green energy to replace brown energy), 2) adapting to the changes that will take place as a result of climate change (e.g., building protections against rising sea levels and rising temperatures), and 3) paying for the damages not prevented. The more that is spent on mitigation in the early years, the less will have to be spent on adaptation and paying for the damage later on.

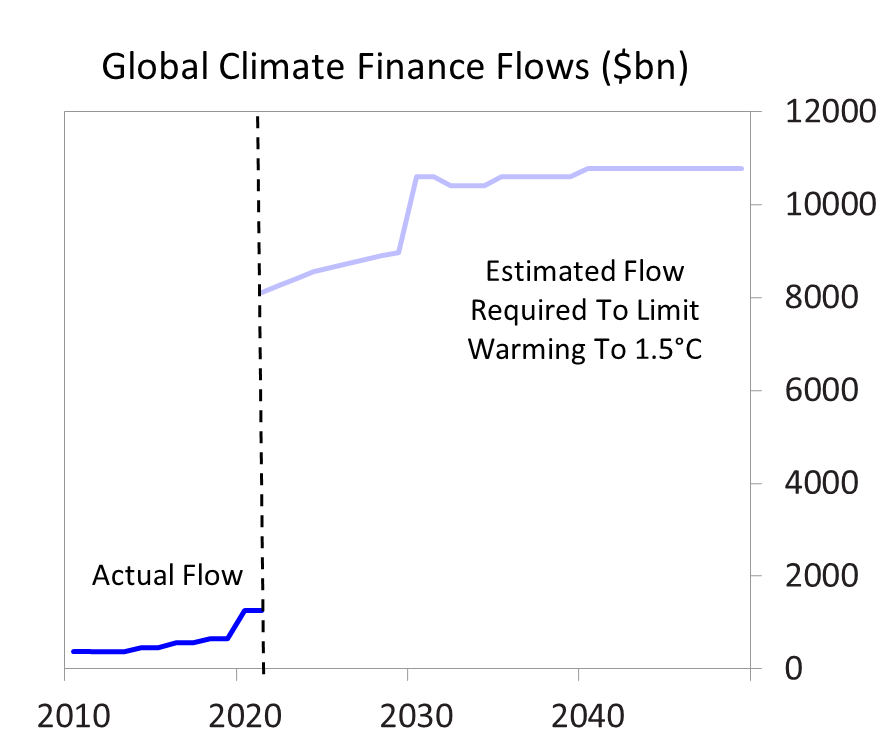

2. Currently, while a lot of money (about $1 trillion a year[¹]) is being spent on trying to mitigate climate change, that is only about one-sixth of the estimated amount of money that is required to keep the rise in temperatures to the targeted 1.5°C, so it should be expected that temperature increases and their effects will be larger than imagined. As a result, the next several decades will require the world to make big, costly adaptations and suffer much greater damages than are now being experienced and are now widely recognized. Because these costly changes will transpire in a really evolving way over several decades, there will be a shifting of resources from trying to mitigate climate change to adapting to the big changes that will come from it.

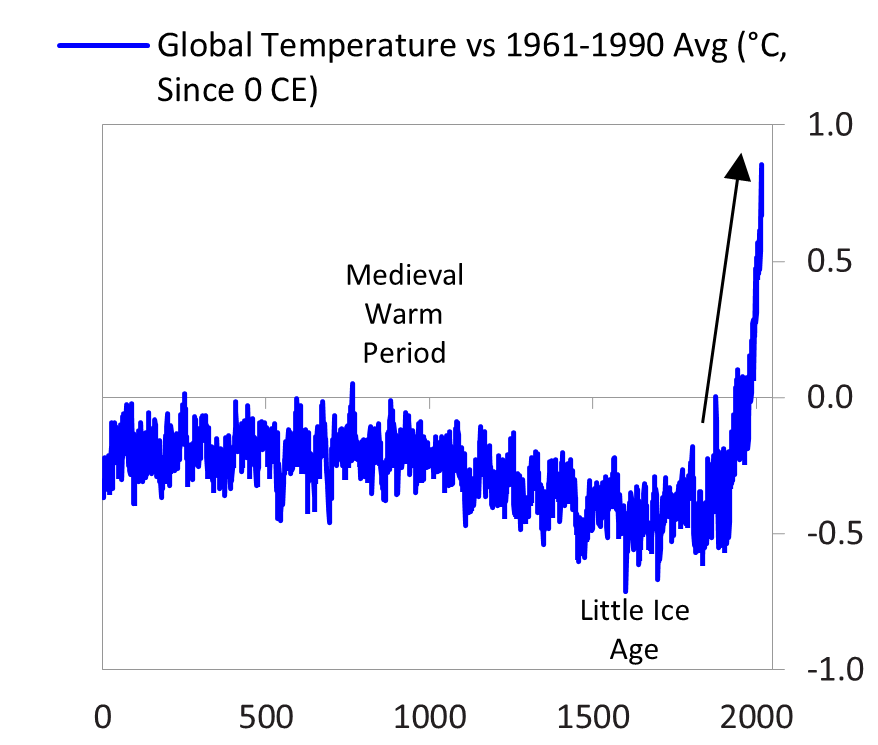

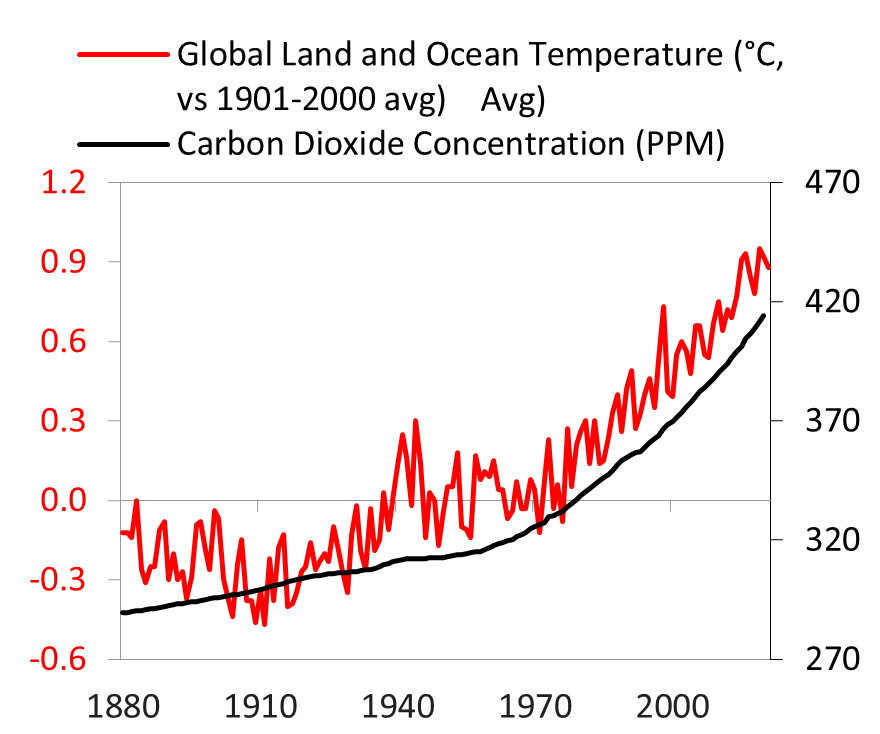

The following six charts do a good job of painting the picture. The first one shows global temperatures since the year 0 CE, and the second shows global temperatures and carbon dioxide (in parts per million) since the year 1880. The magnitudes and forcefulness of these changes are clearly shown in these charts.

Source: IAC, NOAA, Past Global Changes 2k consortium

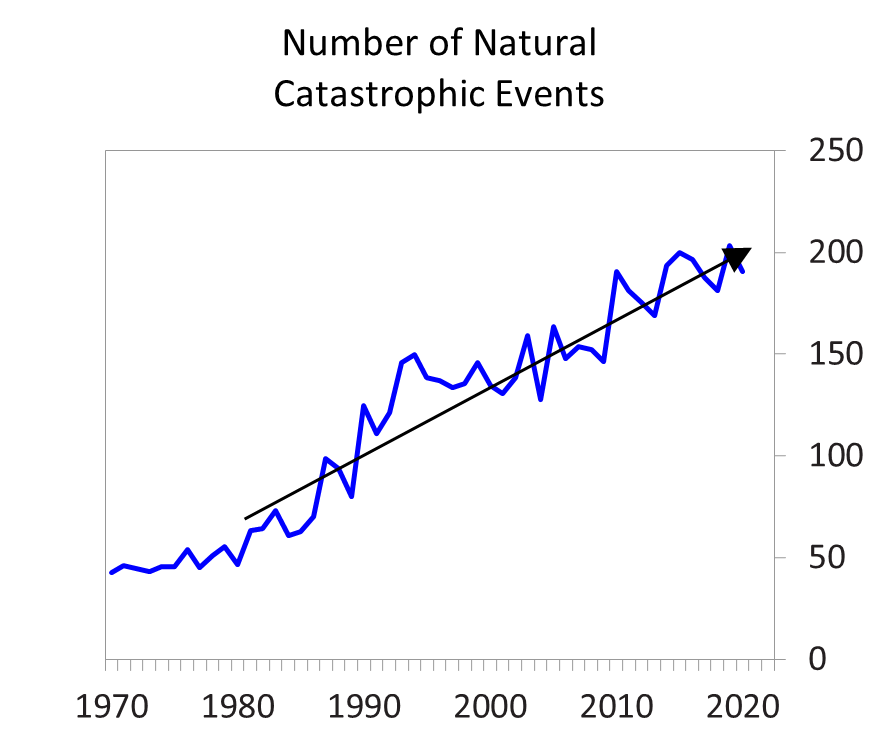

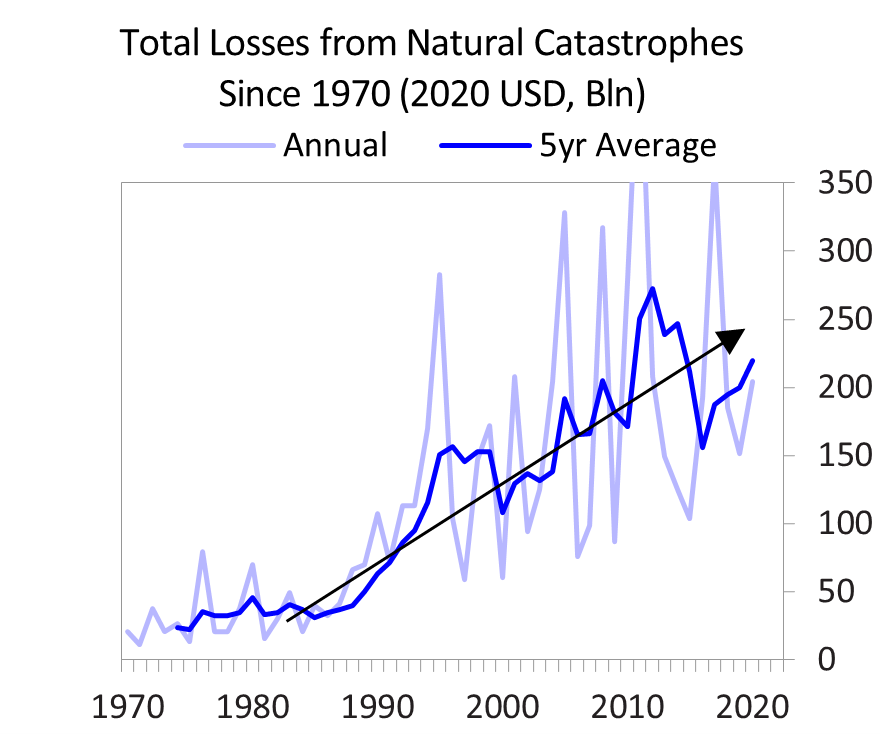

Global temperatures have risen by about 1.4°C above their pre-industrial averages, and the number of natural catastrophic events and the dollar amount of total financial losses both increased by about 4x.

Source: Swiss Re

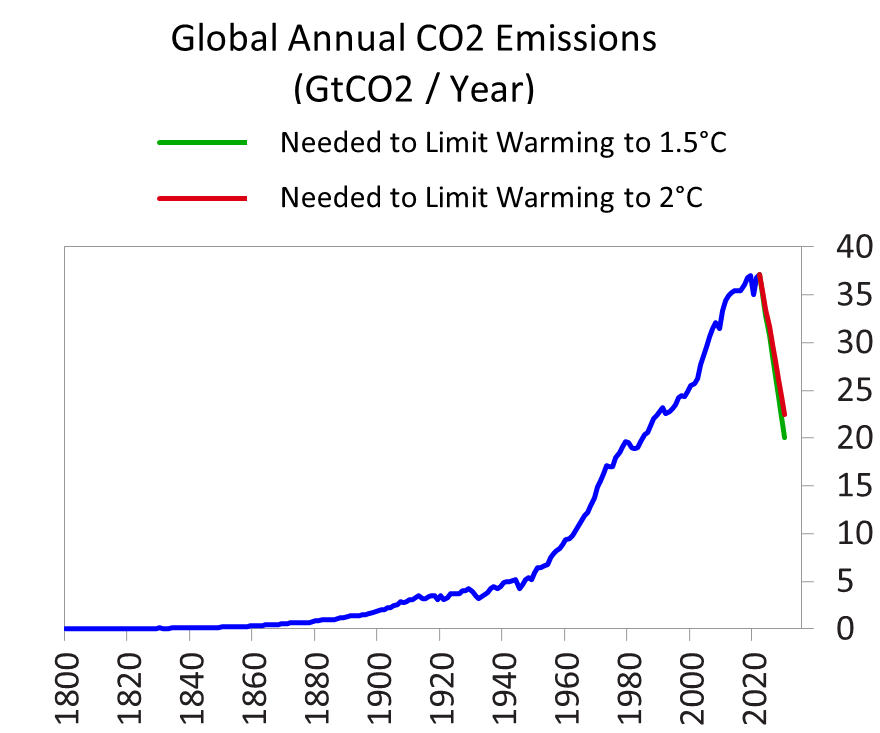

The top chart below shows the actual past and the targeted future amounts that CO2 emissions should drop (25% to 50%) by 2030 in order to contain the global temperature increase to 1.5°C. The next chart shows the actual amounts of money put into climate finance in the past and the estimated amounts that are targeted to be put in from now until 2050 (though there is a very wide range in the estimates of what’s needed). Looking at these charts and knowing what I know about what’s happening leads me to believe that there is virtually no chance that these climate and climate finance goals will be achieved.

Very large emissions cuts needed to limit warming to 1.5°C …

Source: Climate Policy Initiative

… requiring a massive increase in investment.

3. There is too much idealism and not enough pragmatism in figuring out the money part of this puzzle. Until now, we have heard a lot of “we need to spend $ X” without a sensible look at who has the money and what their motivations are. When I looked into this, it became clear to me that the main reasons that more money hasn’t gone into climate finance to help the cause are that a) investing in mitigating climate change hasn’t yet been adequately profitable to attract those with the money to invest in it and b) it is politically impossible to take money from those who have it to give it to fund climate finance. Most importantly, 1) the big money is in the hands of big institutional investors such as pension funds and sovereign wealth funds that need adequate returns to meet their financial obligations to their constituents and 2) government leaders are reluctant to tax and/or cut subsidies for dirty energy.

Let’s look a bit more closely at who has what amounts of money and what their motivations are.

By type of entity:

Individuals invest and give away money philanthropically; both are trivial relative to the amounts required such that they are not noteworthy. For example, the total amount of money that goes to philanthropy globally each year is only about $1 trillion (which is tiny relative to the challenge, and most of that goes to religious organizations, hospitals, and schools, and virtually none of it goes to help with the climate crisis). What will be most important will be individuals changing their behaviors when it’s economical to do so (e.g., because clean energy is cheaper than dirty energy).

Multinational development banks such as the World Bank are also tiny (having only about $2 trillion[²] in assets to use for all their purposes).

Commercial financial intermediaries such as banks have a lot of money (a combined market cap of about $5 trillion for the 100 largest banks in the world and total assets for banks of about $180 trillion[³]), but as financial intermediaries they have to pay adequate returns to those who put money with them, which they get from putting money into well-paying investments and there are not enough climate-change-mitigating investments to make a big difference. If these investments were more profitable, a lot more money would come from this sector.

Governments handle a lot of money and have the powers to tax, borrow, and spend, but they are short of money to put into climate initiatives because it is politically difficult to take a lot of money by imposing taxes and there are limitations to their abilities to borrow. For example, if governments put in carbon or fuel taxes, they could get money and change the economic incentives to discourage spending on dirty energy relative to clean energy, but that would raise prices and take money from their constituents, who would be the real payors for this, which would be politically impossible to do.[⁴] Similarly, if they reduced subsidies for dirty energy, that spending could be cut back with the money saved going into supporting other things, but the practicality of the matter is that government actions that take money away from people are politically limited.

Corporations can change their behaviors in a number of ways that would reduce carbon emissions, which they are now doing, but they can’t do that yet at a large enough scale in part because it isn’t yet profitable enough to do so and much of the emissions aren’t from the publicly listed corporate sector. They have a total market value of about $100 trillion[⁵], but they have to earn returns on the money given to them to satisfy those who gave them the money, so they don’t have much extra money to put into endeavors that don’t provide them with good returns. The hope is that over time the costs of their new practices will decline and other new practices will come along; however, the pace of these changes has thus far been small relative to what’s required. In any case, the key to shifting corporations’ behaviors a lot lies in making these shifts economically viable.

The biggest pool of money—estimated at around $120 trillion[⁶]—is in the hands of institutional investors, most importantly sovereign wealth funds and pension funds that are holding this money for the purpose of taking care of the people they are responsible for taking care of. How would you feel as a pensioner if the pension fund managers cut the returns that they would earn and the money they would give you in order to help the world, especially people in other countries, to have less climate problems? Right now, only about 0.5%[⁷] of this money goes into climate finance because there is a shortage of investments that those who run these institutions can put their money into that provide an adequate return. So, the key to getting the big institutional investors to put more money into climate change lies in finding ways to make it profitable to invest in it.

Looking at the flows of money that are going into climate finance, we can see that around half come from the private sector and almost all the money goes into investments that produce adequate returns.[⁸] So, seeing who has the money and what their motivations are and seeing what is attracting money to help mitigate climate change, it is obvious that making investments that provide both a good financial return and help to reduce global warming — i.e., making good double-bottom-line investments — is what is needed. Bill Gates’s Breakthrough Energy is a great example. There are a handful of such investments that have scale and an enormous number of small, emerging ones that collectively now provide very little money to deal with climate change but have great potential. As I will explain shortly, what is happening in climate-related venture capital deals that provide double-bottom-line returns is very exciting but is unlikely to produce the changes that will achieve the goal of holding temperature increases to 1.5°C and prevent the need for large adaptations to be made and large damages to happen.

4. Differences in the financial conditions of countries will be another impediment to controlling global warming. That is because while “high-income” (developed) countries have the financial resources to deal with the climate issues in their countries (so, in aggregate they will probably meet their emissions targets), the rest of the world doesn’t have the money needed to meet their desired targets, and they won’t get much money from others to help them so they won’t adequately contain their carbon emissions.[⁹]

Since what happens anywhere affects global climate conditions everywhere, and because the emissions increases that will be coming from lower- and middle-income countries (i.e., the “emerging countries”) will be substantial, these emerging countries will not make the climate-mitigation moves that are required for the world to limit global warming. In brief, they will not do what is necessary to limit global warming because 1) their economies / incomes / populations are growing, which leads to greater emissions, and 2) the financial resource gap between those who can provide funding and these emerging countries will make controlling increased emissions growth in the lower- and middle-income countries less effective. It seems very unlikely that global emissions controls will be adequate to prevent significant global warming.

According to the Climate Policy Initiative, 75% of all climate finance has been concentrated in North America, Western Europe, and East Asia and the Pacific (primarily led by China). Emerging countries have not received much investment because of how risky it is to invest in them. It is hard for these investments to get an acceptable return because these countries have political, legal, currency, and rule-of-law risks on top of the risks that the projects won’t work out. Right now, there is an unrealistic discussion going on in which banks and other investors are asking the multinational development banks to guarantee them against the currency and default risks while the multinational development banks couldn’t possibly take on these risks without unacceptably risking their financial well-being. So, the prognosis is that emerging markets need the money and won’t get it. The estimated gap will be $15-30 trillion by 2040.[¹⁰], [¹¹]

5. The best path to dealing with the climate change problem that is also the bright spot in what is now happening comes from where it has always come from, which is humanity’s inventiveness and investing in that inventiveness to produce economically viable (i.e., profitable) endeavors. Talented people enabled by money that is funneled through the capital markets to produce profits and good returns for those who provide it is what is most important to have and is now beginning to germinate in exciting ways.

At COP28, I saw people from around 200 countries working together to be inventive and productive to deal with a common problem so that this was a fabulous lovefest. I think smart venture capital in this area will be a hit area of investment, which is getting me excited about double-bottom-line investing in general and ocean venture capital in particular.

6. It’s time to focus on adaptation. Intolerably hot weather, droughts, floods, rising sea levels, health problems, damage to the oceans that will change currents and sea life, species loss, and many other things will happen and will lead to great monies being spent to enhance humanity’s adaptations to them. In my opinion, there will be a lot more spending and creativeness directed to adapting well because it will be in the self-interests of the parties who are being affected and have the money to do this spending.

At another time, I will look more closely at what types of adaptations will need to be made and what are some of the good types of double-bottom-line investments that I am seeing.

Photos: UNFCCC COP28

Notes:

[¹] Source: UNFCCC

[²] Source: Boston University Global Development Policy Center

[³] Source: Statista

[⁴] There are of course some exceptions like Europe (which has passed some policies that are economically painful), but all of them combined fall far short of what is needed because there is only so much that populations and leaders are willing to take.

[⁵] Source: SIFMA

[⁶] Source: The Atlantic

[⁷] Source: Climate Policy Initiative

[⁸] Source: Climate Policy Initiative

[⁹] Now, approximately 73% of the money that goes into climate-mitigation funding stays within the country that is providing the funding, per the Climate Policy Initiative.

[¹⁰] There are great differences between the conditions of “high-income countries” (with per capita incomes of over about $12,500—think the United States, Western European countries, Japan, Australia, the Gulf states of the Middle East, and a few smaller rich states like Singapore), “middle-income countries” (with average per capita incomes of between $1,100 and $12,500—think most South and Latin American countries, most Eastern European countries, Russia, Turkey, Iran, and some African countries like South Africa), and “low-income countries” (with average per capita incomes of less than about $1,100), and each of these high-, middle-, and low-income countries are broken into two groups, which are the higher and lower ones within the group. I will also point out that now about 27% of the carbon emissions are from China, 15% from the US, 10% from the EU, 6% from other major developed countries, 3% from global shipping and aviation, and 39% from other countries, according to Our World in Data. I won’t digress into this, but I will point out that only 15% of the world’s population lives in the high-income countries that have the money.

[¹¹] For example, per the Climate Policy Initiative, annual investment needs to decarbonize the economy across East Asia (ex-Japan), Latin America, South Asia, Eastern Europe, Africa, and the Middle East are expected to be in the ballpark of $1.5-3 trillion per year.

Text: Ray Dalio

Ray Dalio is founder, CIO mentor, and member of the Bridgewater Board.

This essay was originally published on LinkedIn.